World Bank and UK government heed calls for debt relief for countries hit by climate crisis

Years of collective calls by Quakers and others have led to the UK government and World Bank offering debt pauses to countries experiencing climate crises.

In a move announced at the global finance summit in Paris, the World Bank will allow countries suffering extreme weather events to pause their debt repayments.

However, the move will only apply to repayments on new loans. The UK government will offer similar debt pauses to both new and existing loans to 12 countries in the Caribbean and Africa.

Quakers in Britain, who have called for debt relief for climate-hit nations since COP 25 in Madrid, have welcomed the announcements.

Measure should apply to all

But they asked why the UK Government was only making debt relief available to some countries, and why the World Bank was only applying the measure to new loans.

“Our Quaker testimonies see everyone as equal. We believe that all countries facing climate crisis should have the right to relief.

“We urge the UK government and the World Bank to apply these debt relief measures to new and existing loans to all countries," said Paul Parker, recording clerk for Quakers in Britain.

As a rich nation which has benefited from cheap fossil fuel energy, the UK should support poorer countries already the worst hit by climate chaos, Quakers say.

Debt relief alone is not enough to support countries which are already under huge financial strain through climate crises, campaigners say.

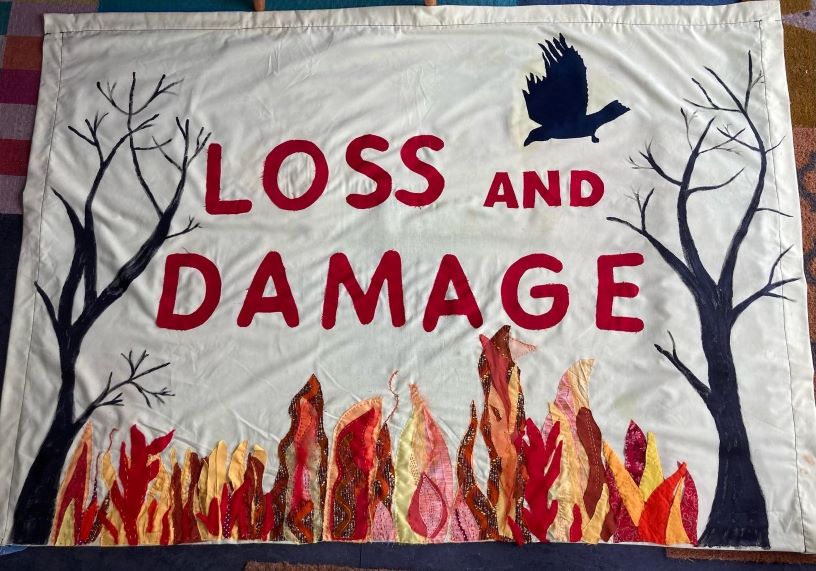

It must go hand in hand with new and additional funding for loss and damage as agreed at COP27 in November last year.

The exact mechanism for that fund is still undecided even as countries on the frontline of the climate crisis grapple with extreme events including floods and deadly heatwaves.

Proposals for sources of funding include taxes and levies on fossil fuels, wealth, and other polluting activities.

It is estimated that by 2030, loss and damage will cost developing countries between $290bn and $580bn every year.